The ease of online ordering is causing more people to eat in, a new study suggests.

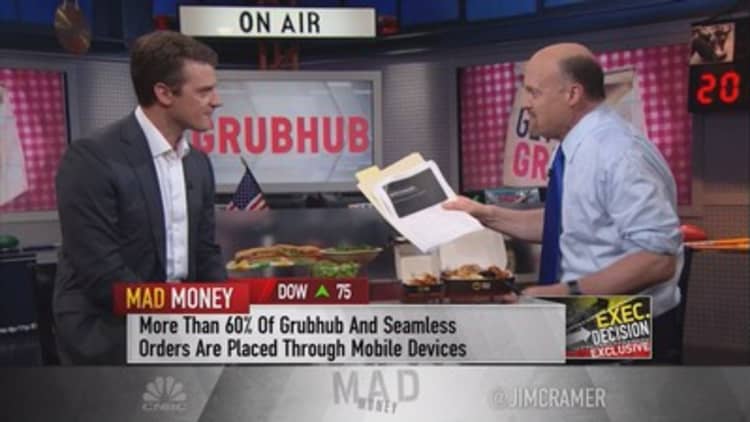

Investment firm Cowen is forecasting a massive 79 percent surge in the total U.S. food home delivery market over the next five years. As the leader in the online market, Grubhub stands to benefit most from booming delivery sales, Cowen said said.

"All in, we forecast delivery to grow from $43 billion in 2017 to $76 billion in 2022, 12% annually over the next five years," said Cowen chief analyst Andrew Charles said in Wednesday's note. "Our Survey data shows plenty of room for Online to take share."

Charles and his team were surprised that online delivery usage was not just booming for millennials, but also for the 35-44 age group.

With online delivery approaching half of the total delivery market, Cowen's analysts expect significant growth in companies like Grubhub in coming years.

Cowen raised its 12-month price target on Grubhub up to $54 from $45. The new target represents 24 upside from Tuesday's close. The positive call follows results from the survey that showed 34 percent of respondents use Grubhub, 70 percent higher than the firm's closest rival.

In the next five years, Cowen predicts that Grubhub will reach 22 percent annual revenue growth.

"We model online delivery growing from $20 billion in 2017 to $55 billion by 2022," continued Charles.

The reported also noted that the rise of chicken and hamburger delivery outside of the traditional staples of pizza and Asian bode well for Shake Shack and Wingstop.

"Cuisines outside of pizza and Asian are handily outpacing the traditional delivery staples," the analysts noted.

Cowen measured the changes in each of the 27 markets' cuisine mixes from August 2016 to today, while incorporating the change in the number of restaurants on the GrubHub/Seamless platform over this time. They concluded that there was a strong correlation between restaurant growth and the diversity of the cuisine.